If Boyd Gaming and Flutter were to partner for a purchase of Penn Entertainment’s digital and retail gambling locations, one company would ultimately own and operate 10 of 20 casinos in Louisiana. For regulators, that’s probably not OK.

There has been a lot of smoke of late about Penn getting acquired. The company has had no comment – not to the June Reuters report that Boyd Gaming made a $9bn acquisition offer or to The Deal story that Boyd might partner with Flutter for a deal.

Such a deal would be reminiscent of the 2019 Caesar’s Entertainment-Eldorado Gaming merger. Those combined companies now own 60 casinos in 16 US states.

The Caesars-Eldorado deal took a year to close. And it wasn’t a straight line from start to finish. The Federal Trade Commission required Eldorado to divest itself of properties in Kansas, Louisiana, Missouri and Nevada.

The FTC wrote that the new company could become “anticompetitive” in those markets. It feared it was possible that Eldorado could “unilaterally exercise market power, which in turn would lead to higher prices and reduced quality.” Regulators in some markets demanded a promise of capital investment and continued competition.

Single company would own 50% of the market

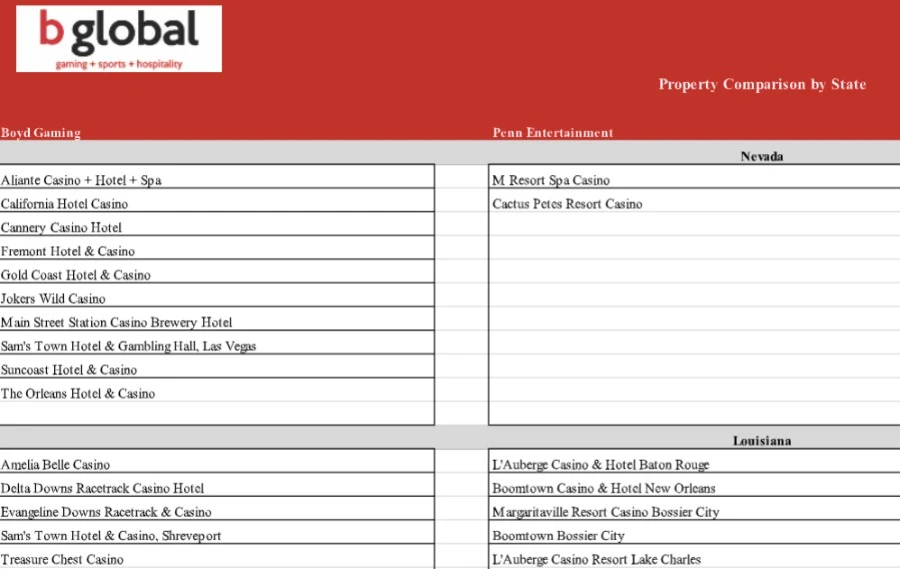

Boyd Gaming currently owns 27 casinos across 10 US states. Penn Entertainment owns 43 brick-and-mortar properties in 20 states. A combined company would mean they would own 70 retail casinos in the US.

Boyd and Flutter have an existing deal under which FanDuel operates brick-and-mortar sportsbooks at US Boyd Gaming properties. FanDuel also gets market access into legal digital gaming states across America through the partnership.

Should Boyd and Flutter move forward with an agreement – and should Penn agree to the purchase – no state would feel the effect more than Louisiana. Let’s call the potential new company BFP.

Under the Bayou State’s gambling laws, there are 20 retail casino licences. Boyd Gaming and Penn each own five, meaning that BFP would own 10, half of all retail casinos in a single state. Bally’s and Churchill Downs also own or operate casinos in Louisiana.

“It would have a huge impact in Louisiana,” former Louisiana Gaming Control Board chief Ronnie Jones told iGB. “It’s unprecedented in Louisiana.”

What would Louisiana regulators do?

Such a deal would also mean that BFP would own five or more retail casinos in five other states. It would own 12 in Nevada, seven in Mississippi and five each in Missouri, Ohio and Pennsylvania.

Jones, who was LGCB chairman from 2013 to 2020, sees plenty of potential issues with having one company own so many properties. But he stopped short of saying that he thinks the current LGCB would force any sales.

“I know for a fact that at least during the last decade, the board has never had to order a company to divest,” he said. “The closest we’ve come is when Golden Nugget acquired a property in Lake Charles and Pinnacle had a property next door.”

In 2013, Pinnacle sold its Lake Charles property to Golden Nugget to satisfy the FTC, which had concerns about deal to purchase Ameristar Casinos. Caesars Entertainment owns five brick-and-mortar casinos in Louisiana since its deal with Eldorado closed in 2020.

That deal, Jones said, raised myriad questions for the regulator.

There were “lots of questions about the issue of competition and having a corner on the market” Jones said. “And this potential merger is five times bigger than that. So even though you ended up with two (Caesars) properties in Shreveport-Bossier, with this, you are going to have half a mile between some of these.”

Here’s what a regulator might mandate

Jones said he’d expect a regulator facing this possibility to ask hard questions. Some examples:

- If a BFP property in Baton Rouge is upgrading its rooms, would another BFP property nearby do the same to stay competitive?

- If a BFP property in Shreveport-Bossier City is offering specials, would another nearby BFP property do the same to bring in customers?

- Would the properties as a group offer competitive promotions to draw in customers?

“I think this would have a chilling effect on the capital reinvestment,” Jones said. “What kind of guarantee do we have that you’re going to keep up all of the properties?”

This is the Caesar-Eldorado merger “on drugs”

International gaming consultant Brendan Bussmann, principal at BGlobal, has similar concerns. He said that while the Caesars-Eldorado merger provides a kind of blueprint, the implications of a BFP merger are far larger.

“This is that merger on drugs because you have so many more properties to deal with in one state,” he told iGB. “So you have to figure out what agencies are going to let you do. It’s no different than the Albertson’s-Kroger merger because you have to create competition.”

In New Jersey, when Caesars and Eldorado merged, it was possible that the new company would own up for four Atlantic City casinos. The Division of Gaming Enforcement had “significant concerns” in considering the merger, reported the Press of Atlantic City.

To assuage those concerns, the DGE required Caesars to create a $400m capital improvements trust account. It also mandated a commitment to reinvesting 5% of annual revenue in the Atlantic City properties.

Eldorado executives complied and the DGE gave its blessing to the merger.

Indiana required Caesars to divest

In Indiana, there were 12 licensed casinos when the merger was announced. Caesars owned four and Eldorado owned one before the merger. According to the Indiana Business Journal, the Indiana Gaming Commission stipulated that the new company must divest itself of three casinos by the end of 2020. It also required the company to continue “maintaining current staff levels at its casinos for at least three years”.

The state’s racing commission also had to sign off on the merger. It had a list of 22 conditions the new company had to agree to, in order to get approval. And so it went from regulator to regulator across the country.

“My goal, if I am a regulator, is to make sure I have a competitive market that continually has investment in it,” Bussmann said. “That investment must continually support the players to provide a good product to my consumers.”

Boyd Gaming doesn’t directly address Penn

It’s not clear if there is anything to the BFP rumours being floated. In a Truist research note earlier this week after Boyd reported second-quarter earnings, analyst Barry Jonas wrote that “we continue to see any large-scale deals as unlikely in the NT (near-term)”.

Jake Pollard in his iGaming Focus report said the deal would not make sense for Flutter because ESPN Bet’s revenue numbers “don’t look strong enough to move the dial for Flutter”. He also pointed out that changing tech stacks and honouring Penn’s marketing commitments could prove challenging.

In its second-quarter earnings call last Thursday, Boyd Gaming executives did not directly address the BFP possibility. But CEO Keith Smith didn’t exactly dismiss the idea.

“I think we’ve developed a great expertise at it,” Smith said of mergers and acquisitions. “We know how to buy properties and companies right and we know how to extract value out of these companies once they’re part of our portfolio.

“We’ve always been willing. It’s not new news to take a hard look at opportunities that arise. We’ll continue to do that.”

Shrinking marketplace

Between mergers and acquisitions, the dominance of DraftKings and FanDuel, and the challenges faced by small operators, it seems clear that legal gambling options in the US will continue to shrink.

But whether a regulator must oversee 20 casinos or two, its goal is to promote competition. With 10 of 20 licences owned by a single entity, that would be a challenge.

“Ultimately the commission has the big stick,” Jones said. “The licences belong to the state and they have to approve the transfer. You have to give us a plan that is gong to resolve [our] concern[s] because we’re not going to give you a licence if you don’t.

“Like other mergers/acquisitions that come before a regulatory body there would be hours of negotiations trying to find the best solution for the state before a final pitch for approval is made. And keep in mind, this isn’t about what’s best for Boyd or Penn, it’s about what’s best for the state of Louisiana.

“And that’s what will guide a final solution for the board.”

Main image: Boomtown Bossier, a Penn Entertainment property in Shreeveport