Tom Waterhouse, of Waterhouse VC’s latest column discusses opportunities for affiliates to enter newly regulated markets – particularly those in crypto betting.

Our previous newsletters, for example July 2022, have explained that wagering affiliates earn most of their income by sending bettors directly to the bookmakers.

Revenue sharing and Cost per Acquisition (CPA) are the two main revenue models. Wagering affiliates can use a variety of strategies to direct traffic toward bookmakers. This includes creating media that is sports-oriented or comparing odds and promotions from different bookmakers.

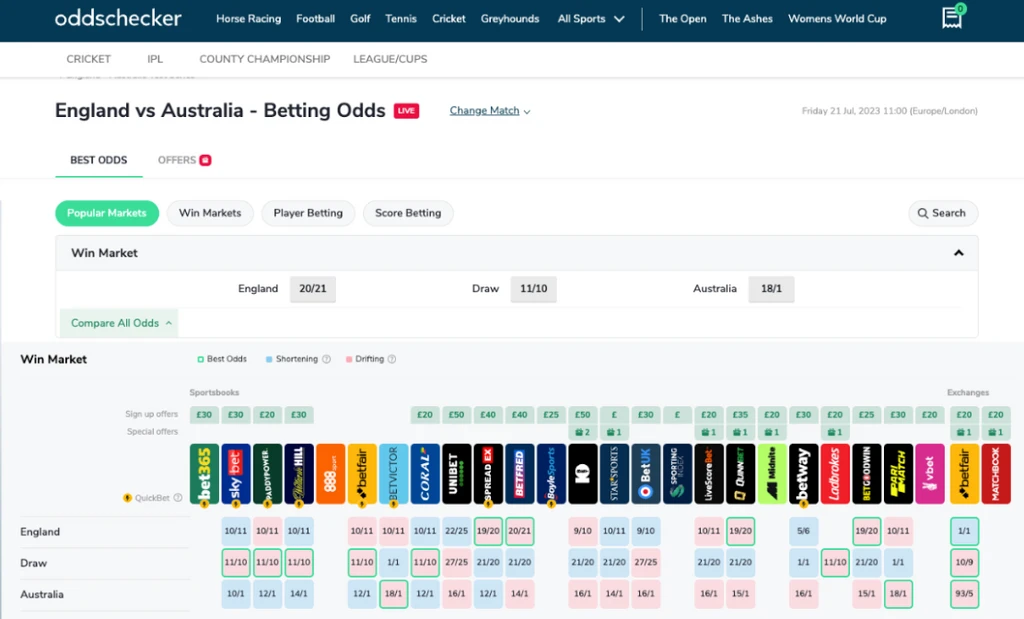

Oddschecker is a popular website that compares bookmakers. This platform offers betting insights and tips, as well as comparing odds and promotions of more than 25 UK-based bookmakers.

Compare odds for 4th Ashes Test

Emerging Markets

Oddschecker affiliates thrive in markets like the US where there is fierce competition for customers. Operators of all sizes spend as much as $1,000 per customer to attract them. It uses all marketing channels available, including affiliate marketing.

Two of the largest US betting operators spent over $1 billion on marketing.

Affiliates from a number of companies have recognized the huge potential that exists in the US. They are therefore concentrating on organic growth in the US and M&A activities.

Better Collective acquired The Action Network for $240m in May 2021. The Action Network provides odds comparisons, podcasts and various other media content.

Comparing odds for Major League Baseball

Bruin Capital acquired Oddschecker in July 2021 from Flutter. The total price was $218m, including $190m up front and deferred payments. This acquisition will allow Bruin to improve Oddschecker’s services and support its entry into the lucrative US Market.

George Pyne of Bruin Capital said that there are many links between Oddschecker’s UK and US development. The US market is fragmented and experts in customer acquisition and discovery will be sought out.

In November 2021 FansUnite purchased American Affiliate, an assortment of US affiliate sites, for $58,2m, which is equivalent to 9.7x EBITDA. American Affiliate delivered 150.000 new customers for US betting operators at the time of acquisition. DraftKings FanDuel, and BetMGM are among them.

Crypto odds

We are excited about the opportunities that the US, and newly-regulated markets in other countries present for affiliates. However, the affiliates who direct bettors to crypto betting operators will have the best results.

Last time we covered crypto betting, it was in May. GlobeNewswire reports that the online gambling industry in general generated revenue of $58.2bn between 2021 and 2030.

The future of the crypto betting industry will be largely driven by its widespread adoption.

Numerous crypto-wagering operators compete for market share, similar to US market dynamics. Affiliates receive a good return for sending depositing players to crypto operators. Affiliates may receive revenue shares as high as 50 percent.

A comparison site dedicated to cryptocurrency operators would be a great opportunity, according to us. As the industry grows, this untapped potential will continue to be attractive.

Mock-up user interface for a crypto operator comparison website

A website that compares odds in the much larger segment of crypto betting presents a huge opportunity. OddsChecker, for example, was sold at $218m.

Affiliates, on the other hand, are valued significantly higher than crypto operators. Better Collective, for example is valued at 12.50x EBITDA.

Betscanner

Betscanner will compare the odds of sporting events provided by cryptocurrency bookmakers.

Data required to compare odds will either be obtained via data scraping, or by direct partnerships with bookmakers. The focus will be on live odds comparisons, the user experience and Esports.

Operators will pay monthly retainers not only to drive traffic, but also in order to retain their existing customers through visibility on the market. The marketing tactics include SEO, Google Ads and influencer campaigns, as well as social media campaigns, exclusive sign up bonuses, and other forms of digital advertising.

Waterhouse VC has a number of exciting projects in which it is involved. One is Betscanner.

Important Notes and Disclaimer

Note that the information above in regards to OddsChecker (FanDuel), DraftKings (DraftKings), Better Collective, The Action Network (Bruin Capital), Flutter, FansUnite and BetMGM, is based upon publicly-available information about the company. It should neither be construed nor considered as advice on financial products. Information provided by Betscanner was used to create the above data. It should not be construed or interpreted as financial advice. Waterhouse VC signed an agreement and an option contract with Betscanner. This document contains general information and is not intended to be investment advice. The reader should seek and follow professional advice on investment specific to his or her circumstances.

Only General Information

The material provided is only for informational purposes and does not constitute an offer to buy or sell any financial products or services. This material was prepared to provide information to investors that qualify under section 761G Corporations Act as wholesale clients or for any other individual who does not need to receive a disclosure document that is regulated under Corporations Act. This material does not provide financial or tax advise and it is not tailored to your needs, objectives or financial circumstances. We believe the information is accurate, but we do not guarantee its accuracy, completeness, or reliability, with the exception of statutory liability. Sandford Capital or Waterhouse VC, or anyone else, does not guarantee performance or a specific rate of return. Sandford Capital or Waterhouse VC, as well as any other party, do not assume any responsibility for the statements in this material.

Financial Regulatory Oversight and Administration

Waterhouse VC, an Australian Unit Trust in AUD is available for wholesale investors with a minimal investment of AUD 1,00,000. This can be converted to USD, EUR or GBP. The Trustee for the Waterhouse VC Fund, Waterhouse VC Pty Ltd, (ABN 48 635 494861) (also known as ‘Waterhouse VC,’ ‘Trustee,’ ‘us, or we), prepared this material. The Trustee, Sandford Capital Pty Limited is a corporate authorised rep (CAR 1296688) and AFSL 461981. Sandford Capital has been appointed as the AFS licensed mediator by the Trustee under s911A(2)b) Corporations Act 2001.

Performance

Waterhouse VC’s past performance is not a reliable predictor of its future performance. Waterhouse VC Pty Ltd cannot guarantee that any particular strategy will perform or return an investor’s money or any rate of return. Taxation has not been taken into account, where appropriate. You should consider investing in the long term.

Copyright

Waterhouse VC Pty Ltd ACN: 635 494861 Copyright. Waterhouse VC has given permission for this message to be used in its entirety or part.

Governing Law

The laws of New South Wales govern and should be applied to these Terms and Conditions. Accepting these Terms and conditions of use means that you consent to the nonexclusive jurisdiction of New South Wales courts, Australia, in relation to any proceeding relating these Terms.

.