Lawmakers from states with legalized gambling are suggesting guidelines for states considering online gambling, including a 15-25% tax rate and a ban on credit card deposits.

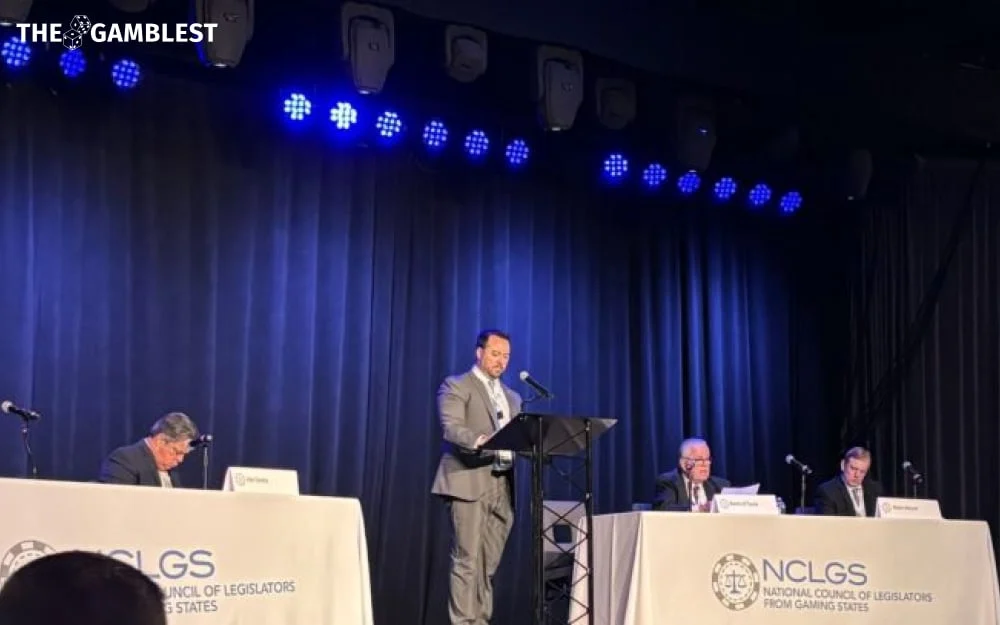

The National Council of Legislators from Gaming States released model legislation to help states considering internet gambling. The proposal will be reviewed at their winter meeting in New Orleans. Currently, seven states offer legal online casino games, while Nevada allows only internet poker.

Shaun Fluharty, the president of the National Legislators Group, mentioned:

Many states have been discussing this, but were having a hard time getting it across the finish line. We’re trying to put together some best practices for them.

To ensure consumer protection and integrity in internet gambling, the proposal includes strict oversight and suggests creating a regulatory agency if needed. It limits daily deposits to $20,000 and prohibits credit card use for funding accounts. The recommended tax rate of 15%-25% exceeds the national average of 19%, however, remains below Pennsylvania’s high rates of 36% for sports betting and 54% for online slots. West Virginia taxes at 15%.

Fluharty added:

The thinking was we didn’t want to form a barrier to entry into the market with a high tax rate that only the biggest companies could afford.

Fluharty also shared that Maryland’s internet gambling bill passed the House but not the Senate in April. Ohio and Louisiana are also weighing their options, while New York’s attempt to tax online casinos at 31.5% remains unsuccessful, despite allowing online sports betting. Rebuck forecasted that more states will explore internet gambling amid rising budget challenges.

New Jersey’s 13% tax on online sports betting and 15% tax on online casino games generated over $414 million in tax revenue last year and is on track to nearly match that total in the first 10 months of this year.

President-elect Trump, who also was a former casino owner, supported state control and took no steps toward federal regulation during his first term.