In his latest column, Tom Waterhouse of Waterhouse VC shines a spotlight on three industry leaders and discusses their paths to success.

In every industry, there are prominent figures who stand out and the wagering industry is no exception.

This month, we shine a spotlight on three distinct leaders in the industry: Tim Heath, a crypto wagering pioneer; Peter Jackson, CEO of Flutter Entertainment; and David Walsh, renowned as one of the world’s largest professional horse racing gamblers.

Over the last decade, the online wagering industry has expanded significantly through the proliferation of mobile-focused platforms. Heath and Jackson lead companies at the forefront of digital innovation in the industry.

YOLO

Originally from Australia, Heath is a serial wagering industry entrepreneur and venture capitalist. After university, he started a software development and ecommerce firm, Heathmont.net.

In 2013, he launched Coingaming Group, a crypto wagering operator and supplier which rebranded to Yolo Group in 2021. Yolo Group is now most known for its large B2C wagering operators, Sportsbet.io and Bitcasino.io. We have discussed the rapid growth of crypto wagering and Sportsbet.io in previous newsletters.

With over 600 employees, Yolo is a well-established group of businesses across wagering and venture investing. Yolo’s B2C brands pioneered the integration of streaming for all major sports and were very early innovators of the now common “cashout” feature.

Sportsbet.io and Bitcasino.io offer players withdrawal times as fast as just 1.5 minutes, ranking among the swiftest in the industry.

Heath’s relentless focus on customer experience has made Sportsbet.io one of the largest global crypto wagering operators. The company records over US$2.7bn of turnover per month. To put that in perspective, in 2023, Australia’s largest operator averaged US$1.2bn of turnover per month and has around 50% market share in the country.

What’s next for him? One thing he would like to reform is the international payments landscape, which today predominantly relies on the SWIFT system. He believes that SWIFT has several inefficiencies, such as delays and lack of privacy.

World domination

Jackson, meanwhile, has been the CEO of Flutter Entertainment since January 2018. Under his stewardship, the company’s valuation has doubled and it is now the world’s largest publicly listed wagering company. Only Bet365 – privately owned by the Coates family – comes close to Flutter in global scale.

Flutter is the only publicly listed B2C wagering operator in our portfolio at Waterhouse VC.

Jackson graduated with a degree in manufacturing engineering from Cambridge and honed his skills during a three-year stint at McKinsey. He then transitioned to various roles at the Halifax Bank of Scotland until its acquisition by Lloyds in 2009.

At 34, he was appointed the CEO at Travelex, a foreign exchange company. He led the company for five years, bolstering revenues and eventually overseeing its £1bn sale. He served on the board of Betfair from 2013 before being appointed Flutter’s CEO five years later.

Early on in his tenure, Jackson recognised the importance of scale and efficiency in an industry which is highly taxed and highly regulated. Leveraging his experience in consulting and banking, Jackson has developed operations that lead their respective markets through a combination of organic expansion and M&A activity – such as MaxBet and Junglee Games.

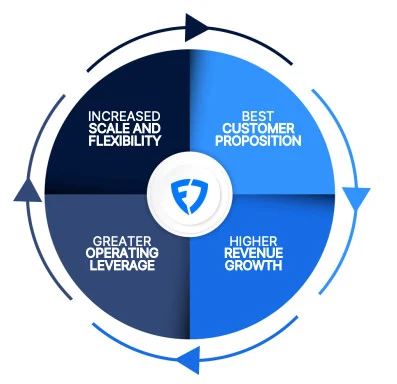

The flywheel effect

By leveraging the broader Flutter Group’s access to global industry knowledge, technological development, customer insights and data analytics, each of Flutter’s divisions benefits from a “flywheel” effect.

This flywheel has driven Flutter’s US business, FanDuel, to an 11-fold increase in revenue from US$300m in 2018 to around US$3.3bn in 2022, with an industry-leading 37% market share today.

Jackson was instrumental in effecting the recent dual-listing of Flutter on the New York Stock Exchange (NYSE:FLUT). The company listed on 29 January this year, enhancing access to US capital markets and simplifying the provision of stock incentives to employees based in the United States.

Historically, US equities have commanded higher valuations compared to other global equity markets. Flutter’s shareholders stand to gain from an increased valuation, while the company could leverage its premium valuation to raise cheaper additional capital.

MONA

The wagering industry provides entertainment to people at a cost. There is a very small group of people who bet profitably – they do not need to pay for the entertainment.

We believe that, globally, there are fewer than 50 betting syndicates capable of winning at scale. David Walsh is regarded as one of the world’s most successful gamblers through the syndicate in which he is partnered with Zeljko Ranogajec.

The syndicate bets globally on horse racing, sports, lotto, casino and financial markets. It has been reported that the syndicate turns over in excess of $3bn per year. However, some estimate that their global turnover is far higher.

Walsh invested $75m to open the Museum of Old and New Art (MONA). As a result of his contributions, Walsh was honoured as an Officer of the Order of Australia (AO) for his outstanding service to the visual arts and for his support of various cultural, charitable, sporting and educational organisations.

Can emerging syndicates compete?

Professional bettors are incredibly bright and have a rare skillset. They understand the unique dynamics of each sporting code/casino game/lottery back to front.

They are able to model 100s of factors that predict the “true” likelihood of a result. Then they can put it all together to run a professional betting business, which relies on managing a huge number of people.

Focusing on racing in particular, a team of experts in mathematics, statistics and computer science regularly develop, maintain and refine algorithms that assess vast amounts of historical racing data and individual factors specific to racing – such as track conditions, jockey statistics, sectionals, weather and bloodlines – to inform betting decisions.

As discussed last month, racing betting syndicates are also advantaged by receiving rebates on their wagers regardless of the outcome. To qualify for the rebates, syndicates must wager vast amounts of money. The rebates effectively enhance their existing “edge”, making it increasingly challenging for emerging syndicates to compete in racing.

Waterhouse VC is a fund for wholesale investors, specialising in global publicly listed and private businesses related to wagering and gaming.

Since inception in August 2019, Waterhouse VC has achieved a gross total return of 2,858% as at 29 February 2024, assuming the reinvestment of all distributions.