Sportsbooks in the U.S. suspend betting during college football games significantly more than they do during NFL games, according to a new report from sports intelligence data firm Bettormetrics.

The data also illustrated just how much in-game betting uptime during football games varies from operator to operator.

The company conducted a one-week comparison of suspension times between top sports betting operators during week eight of the college football season and week nine of NFL, between Oct. 31 and Nov. 4. Suspension occurs when a sportsbook periodically shuts down betting lines on an event to readjust odds based on activity within the event.

DraftKings and FanDuel have the least downtime

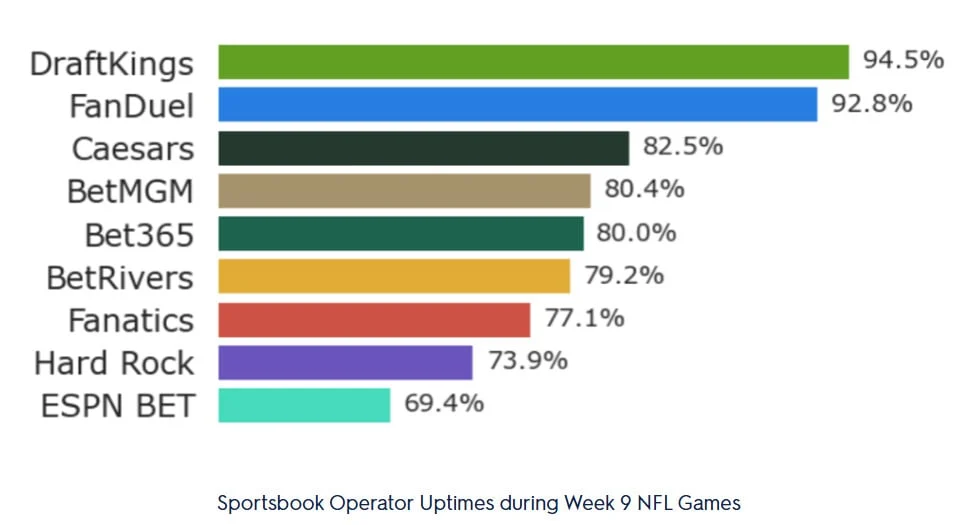

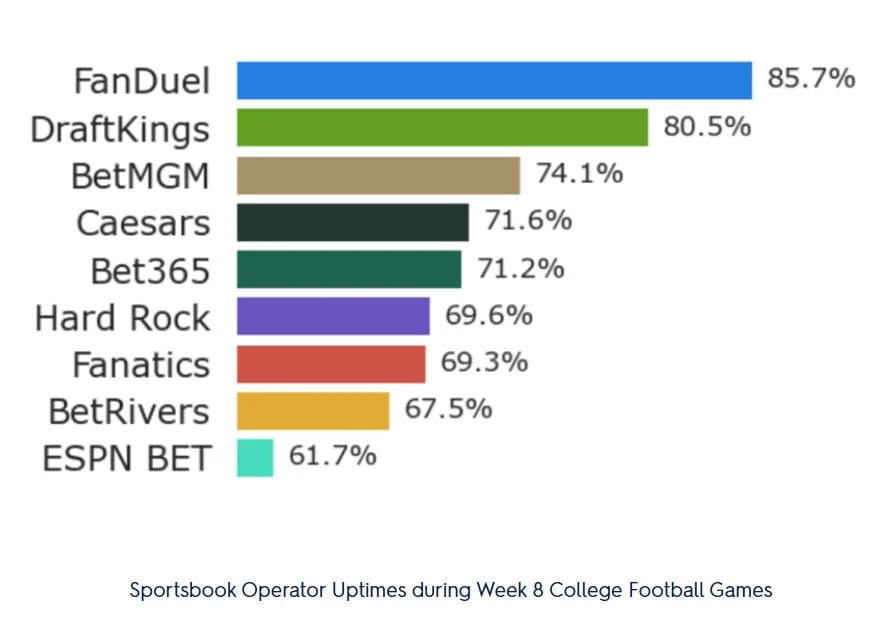

The analysis found that uptimes for college football games lag behind those during NFL games, with some sportsbooks such as DraftKings experiencing a big difference between the two.

DraftKings and FanDuel, the two U.S. market leaders, were suspended for the least amount of time during NFL games. They were also the top two when it comes to college football uptimes, although FanDuel led the way for CFB. DraftKings suffered the biggest comparative drop-off in uptimes between NFL and college games when compared to its NFL suspension times.

On average, operators’ suspension times were 8.7% worse during college games.

ESPN Bet, which is still looking to establish itself as a firm competitor among the second tier of online sportsbooks underneath FanDuel and DraftKings, performed the worst for both kinds of football. Even for NFL games in week nine, betting was suspended for more than 30% of game time.

ESPN Bet’s week 9 NFL uptime was more than 20% worse than FanDuel and DraftKings and significantly lower than most of its competitors.

Still room for sportsbooks to improve college football outages

“The NFL is clearly the American bettor’s favorite competition so it is only a matter of time before sportsbooks shift their focus to its younger sibling, college football, seeking improvements in suspension, uptime and overall trading performance,” opined Bettormetrics’ Chief Revenue Officer Sabin Brooks. “Those who master suspension in college games will ultimately come out on top. Doing so is a win-win because the bettor will have an improved betting experience meaning they will keep coming back and the operator will be able to bring in more handle, meaning a flywheel of better product, customer experience and sportsbook profitability.”

“While there are challenges with the availability, quality and speed of scouting data for college football, there is clear demand for betting on NCAA football. As such, operators are going to need to find solutions to overcome the tremendous suspension differences between the NFL and college football,” added Bettormetrics Co-Founder and CEO Robert Urwin.

“While we recognize that there are significantly more college games every weekend during football season than NFL, there is work to be done. With an estimated gross gaming revenue of over $800 million coming in during college football season, sportsbook operators will continue to lose out on potential revenue unless suspension times are addressed.”