Reading Time: 4 minutes

SOFTSWISS, a tech company and pioneer in crypto gaming with over 15 years of experience, conducted a survey revealing that the majority view crypto as a key driver for growth in new markets. Experts also analysed this year’s crypto bets to share the latest insights.

Bitcoin recently reached a historic high, getting closer to 90,000 euro per coin. However, during the third quarter of 2024, it faced its sharpest drop in several years. SOFTSWISS experts examine how these market shifts have influenced iGaming performance in the quarterly ‘State of Crypto’ analytics.

A Quarter of the World’s Population Engages in iGaming

Global iGaming statistics indicate that approximately 26% of the world’s population were ever engaged in iGaming. By 2028, the iGaming market is projected to reach 243.2 million users, with a market volume nearing 130 billion euro, a substantial portion of which is expected to involve cryptocurrency.

SOFTSWISS data shows that during the 9 months of 2024, the Total Bet Sum, including both fiat and crypto, increased by 43.1% compared to the same period of 2023. Simultaneously, the Total Bet Count showed even more impressive growth, surpassing 44.5%.

An in-depth comparison analysis since 2022 demonstrates fiat bets are rising much more rapidly than crypto. A comparison between the first nine months of 2024 and the same period of the previous year revealed that the Fiat Bet Sum achieved a 50.4% boost. The conservative approach toward payment methods has resulted in Crypto Bet Sum growing at a slower pace compared to fiat and has led to a modest 4-percentage-points (p.p.) decline in the crypto share in 2024.

[1] Based on data from ongoing projects[

Potential of Crypto in iGaming 2025

According to the SOFTSWISS iGaming Trends 2025 Report, cryptocurrency is set to remain one of the preferred payment methods within the sector. Based on the company’s survey, 58% of respondents identified crypto as the primary driver of growth in new markets, underscoring its essential role in shaping the industry’s future.

Vitali Matsukevich, Chief Operating Officer at SOFTSWISS, reflects on the possibilities of crypto: “Integrating crypto payments allows iGaming businesses to operate globally, delivering greater speed and convenience. With iGaming’s naturally borderless reach, this expands platforms’ access to a wider international audience, boosting their global growth potential.”

“What is more, crypto transaction fees can be almost three times lower compared to traditional fiat gateways, allowing iGaming businesses to save on processing costs and reinvest that capital”, adds Max Krupyshev, CEO of CryptoProcessing by CoinsPaid.

SOFTSWISS data confirms stable interest in crypto. In the first nine months of 2024, the Crypto Bet Sum increased by 15.2% compared to the same period the previous year. A long-term quarter-by-quarter analysis reveals a consistent growth pattern, though the third quarter of 2024 saw a 9 p.p. decline from the previous quarter. The drop aligns with the decline in the exchange rates of major cryptocurrencies, including Bitcoin, Litecoin, and Ethereum, which occurred in the third quarter.

Meanwhile, the Crypto Bet Count rose by 16.2% in Q3 2024, indicating stable interest in crypto gaming. This combination reveals that while engagement in crypto betting remains steady, the total wagered sum is closely correlated to fluctuations in cryptocurrency exchange rates.

Altcoins Share Growth

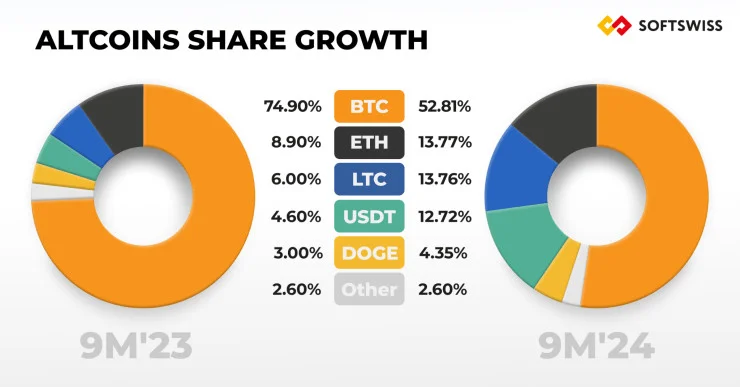

The top five most popular cryptos in iGaming have remained stable over the years, with some shifts in the ranking order. Bitcoin, Ethereum, Litecoin, Tether, and Dogecoin are the most popular among crypto players. While altcoins accounted for only 25.1% of bets over the first nine months of last year, their share increased significantly to over 47% during the same period in 2024.

Bitcoin’s share dropped by 22 p.p. during the nine months of 2024 compared to the same period of 2023. At the same time, Tether and Litecoin saw the most impressive share growth, with over 8 p.p. and 7.8 p.p., respectively. Ethereum strengthened by 4.9 p.p.

Another impactful trend reveals some casinos, like Rollbit and Shuffle, utilise their own iGaming tokens to boost player engagement. Tokens designed specifically for gaming offer enhanced compatibility across platforms, lower volatility, and exclusive perks for users. Crypto drives the development of new payment methods and business growth.

Vitali Matsukevich summarises: “Crypto offers iGaming operators key advantages beyond lower costs and global reach. Blockchain enhances safety and fairness through transparency and traceability, with each transaction and game result permanently recorded and tamper-proof. Partnering with trusted crypto experts allows operators to harness these benefits, positioning themselves for growth and effectively navigating market shifts.”

The new SOFTSWISS iGaming Trends 2025 Report offers more insights about crypto in the ever-evolving iGaming sector. The visionary report is free to download via the link.

About SOFTSWISS

SOFTSWISS is an international technology company with over 15 years of experience in developing innovative solutions for the iGaming industry. SOFTSWISS holds a number of gaming licences and provides comprehensive software for managing iGaming projects. The company’s product portfolio includes the Online Casino Platform, the Game Aggregator with over 23,500 casino games, the Affilka affiliate platform, the Sportsbook software and the Jackpot Aggregator. In 2013, SOFTSWISS revolutionised the industry by introducing the world’s first Bitcoin-optimised online casino solution. The expert team, based in Malta, Poland, and Georgia, counts over 2,000 employees.