In his latest column, Tom Waterhouse of Waterhouse VC analyses how gambling monopolies operate in regulated markets.

A coffee for $10? It’s too much, but if you are the only cafe in town, you have pricing power – and people love coffee.

So monopolies commonly exist in regulated wagering markets. They have significant advantages in that they offer exclusive products, have widely trusted brands and a strong relationship with the government and the industry. However, due to a lack of competition and a limited product offering, it can sometimes lead to a suboptimal outcome for consumers.

Examples of some monopolies are provided below.

Happy Valley

Established in 1884, the HKJC has a rich history rooted in horse racing. The club’s inaugural races were held at Happy Valley. The club actively contributes to charitable causes, becoming a hallmark of its identity and position in Hong Kong’s economic landscape.

In 1959, regulatory changes through the Betting Duty Ordinance expanded the HKJC’s scope to allow off-course betting.

The HKJC incurs a 50% duty on its gross margin from football, while the duty on racing reaches up to 75%. In the 2022-23 fiscal year, the HKJC gave back US$4.6bn to the community. This comprised US$3.7bn contributed to the government in the form of duty, profits tax and Lotteries Fund contributions, along with US$0.9bn in donations to charities.

B2Bs and monopolies

At Waterhouse VC, we focus on B2B suppliers that provide a critical or innovative service to wagering operators. Nearly every wagering operator requires odds pricing, trading and risk management, player account management (including KYC/AML compliance), customer engagement and marketing services.

Similarly to other operators, monopolies benefit significantly from technological advancements in the industry, closely monitoring trends in product offering and integrating with innovative B2B products. There is a huge opportunity for B2B suppliers to integrate with monopolies. For example, Voxbet – one of our portfolio companies – has had PMU as a client for seven years.

If monopolies maintain a modern technology stack and are permitted to develop a full product offering, it could give them the technological capability, product offering and great customer experience required to expand their already well-known brand outside their domestic jurisdiction to operate effectively in more competitive regulated markets.

Geographical expansion would also allow them to increase their tax contributions and charitable activities in their home country.

By applying their domestic experience, product offering and technology stack to other markets, monopolies could echo Flutter’s global strategy. Flutter developed its expertise in the UK through Paddy Power before expanding to Australia (Sportsbet), the US (FanDuel) and globally (local heroes including Sisal and MaxBet).

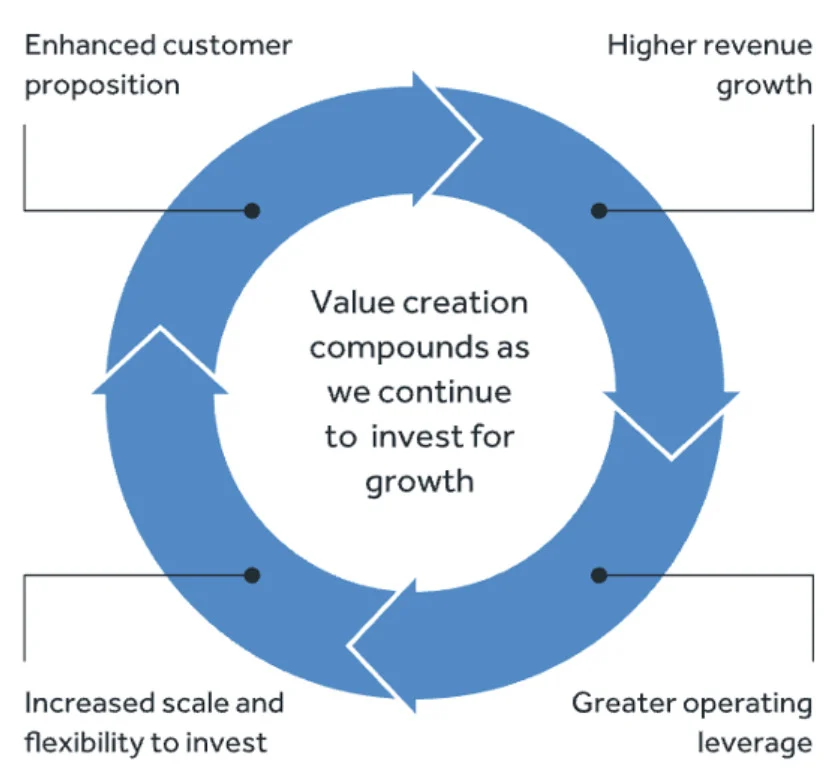

The company has cultivated market-leading global wagering businesses by leveraging its expertise and resources in product development, customer insights and data analytics. They have effectively taken advantage of operational leverage, leading to a “flywheel” effect.

Bleeding out to unregulated operators

On 5 September, following its annual general meeting, the HKJC specifically highlighted the leakage that has been occurring as wagering volumes shift towards unregulated operators.

“In the digital age, the club faces significant competition from illegal bookmakers who pay no tax, and from overseas sports betting bookmakers who operate under very low tax regimes,” it said. “Illegal and overseas betting operators are already earning profits in excess of HK$15bn a year from Hong Kong customers.

“If betting duty rates increase the club would face a significant decrease in income and would be less price competitive. As a result the club would be unable to invest for its future.”

Taxation revenue leakage is occurring throughout regulated wagering markets. For example, in the US, it is estimated that unregulated operators attract annual bets totalling US$510.9bn from Americans. This leads to a substantial loss of US$44.2bn in gaming revenue for the regulated betting industry and a loss of US$13.3bn in tax revenue for state governments (“Sizing the Illegal and Unregulated Gaming Markets in the United States” – American Gaming Association, 2022).

Filling gaps in product to grow monopolies

Relying solely on their monopoly position is not an optimal strategy for monopolies, particularly in the context of increasingly accessible unregulated wagering. Unregulated wagering will compel monopolies to engage in at least some level of competition and they must deliver an attractive product offering and customer experience. As regulated monopolies face continued pressure from unregulated operators, they must consistently innovate to retain and attract customers.

In markets where some wagering products are banned – such as igaming and sports outside of football in Hong Kong; or igaming and in-play wagering in Australia – introducing a monopoly licence covering product gaps could significantly reduce leakage to unregulated operators while increasing taxation and charitable donations. This would also protect bettors as unregulated markets generally provide lower levels of consumer protection.

If a monopoly operator is unable to provide a comprehensive range of wagering products within their domestic jurisdiction – including pre-match sports, in-play sports, racing, igaming, lottery and bingo – unregulated operators seize the opportunity to attract customers and further enhance their own “flywheel”.

In this scenario, monopolies are not maximising their potential domestically – let alone internationally.

For wholesale investors interested in following wagering and gaming industry news and trends, please follow Waterhouse VC updates on Twitter (@waterhousevc) or through our website at WaterhouseVC.com.