September’s Eilers-Fantini report has been published, with many studios witnessing consistent performance across North America over the past month.

One firm that may have cause to celebrate after looking at Eilers & Krejcik’s Canadian report is Light & Wonder, after the studio shot to the top of the supplier charts to knock IGT and Evolution out of their usual top two places.

Meanwhile, the US charts witnessed another month of strong performance from IGT’s fireball-themed slot release as Cash Eruption outperformed the competition in several verticals.

US figures

It was another resilient month for IGT’s Cash Eruption slot in September as the title sat atop the top slots by GGR charts, though it lost a portion of GGR share which came in at 2.7%, dropping from August’s 3.09%.

Evolution’s Live Dealer Roulette leapfrogged the competition to claim second place, taking a 1.57% GGR share (August: 1.07%), while Aristocrat’s Buffalo slot dropped one place to round out the top three with 1.45% (August: 1.56%).

IGT and Evolution both featured in the top five once more, with the former’s Blackjack table game falling from third place to fourth with 1.14% (August: 1.34%).

Evolution’s Live Dealer Baccarat came in fifth place with a 1% share of GGR, rising from August’s sixth place with 1.03%.

From the top games per GGR, 15 were slot titles, three were table games and six were live casino titles, with no video poker games making the top 25 for just the second time this year.

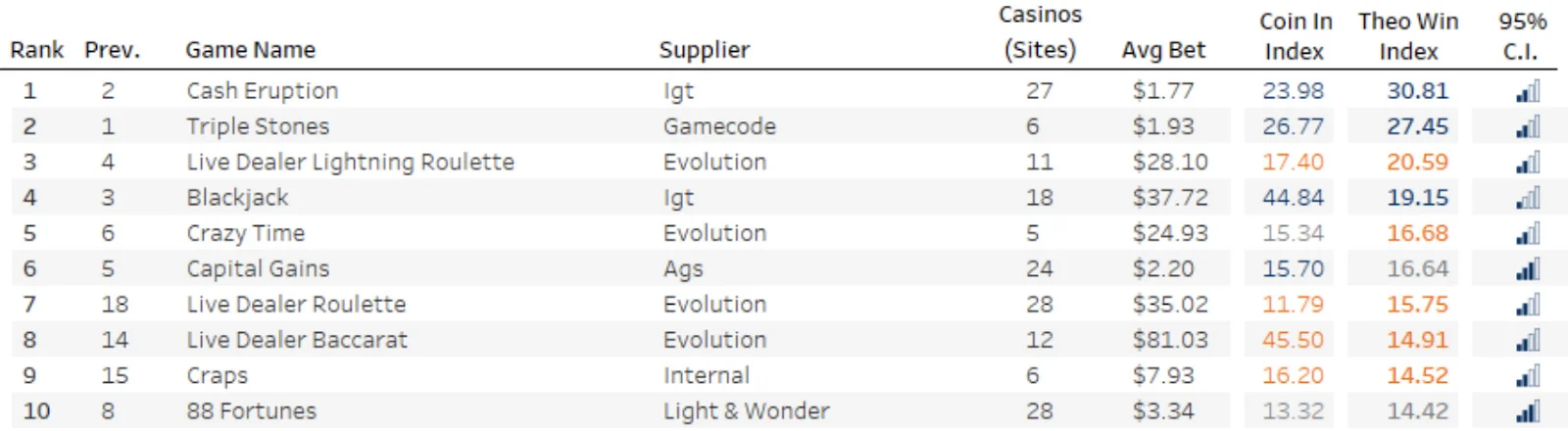

While Gamecode’s recent Triple Stones slot release stormed its way to the top of the overall games charts last month, Cash Eruption reclaimed its usual perch in September, knocking the former down to second place.

Live Dealer Lightning Roulette from Evolution and IGT’s Blackjack traded places this month, placing third and fourth respectively. As did Evolution’s Crazy Time title with Capital Gains from AGS, placing fifth and sixth respectively.

The remainder of the top 10 titles were shaken up completely as Live Dealer Roulette from Evolution rose from 18th place to seventh, while the studio’s Live Dealer Baccarat title climbed from 14th place to eighth, Craps by Internal rose to ninth from 15th and 88 Fortunes from Light & Wonder dropped from eight to 10th place.

Looking at the top slot charts, Cash Eruption, Triple Stones and Capital Gains made up the top three in that order, while 88 Fortunes rose from fifth to fourth and last month’s 10th place finisher Hypernova Megaways from Reel Play rounded out the top five.

Overall, 12 suppliers were represented in the top slot charts, with Reel Play, Aristocrat, Greentube, Everi, Games Global, Inspired and DWG all featuring at least once.

For the new game rankings, five of the top 10 were new rankings for the second month in a row as completely new releases continued to perform strongly in September.

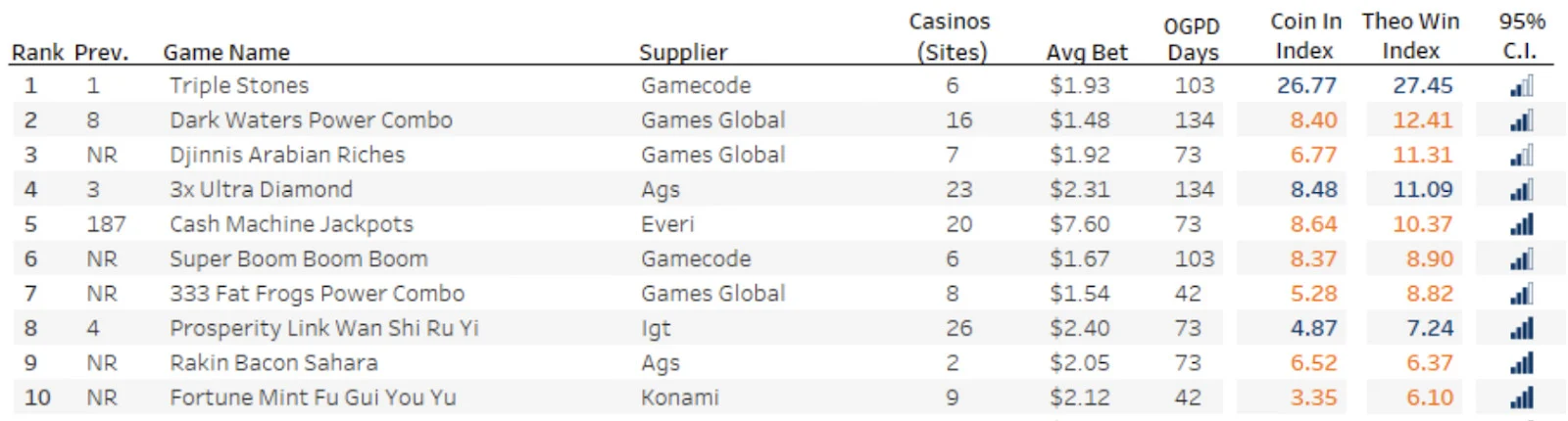

Triple Stones remained in top spot, while Games Global’s Dark Waters Power Combo shot from eight place to second. 3x Ultra Diamond from AGS fell to fourth as new ranking Djinnis Arabian Riches, another title from Games Global, took third and Cash Machine Jackpots from Everi climbed 182 places to place fifth.

Gamecode’s Super Boom Boom Boom, 333 Fat Frogs Power Combo from Games Global, two new rankings, Prosperity Link Wan Shi Ru Yi from IGT, AGS’ Rakin Bacon Sahara and Fortune Mint Fu Gui You Yu from Konami, another two new rankings, rounded out the top 10 in that order.

For yet another month, each game that appeared in the top 25 new game rankings was a slot title, providing more evidence for the vertical’s dominance in the US.

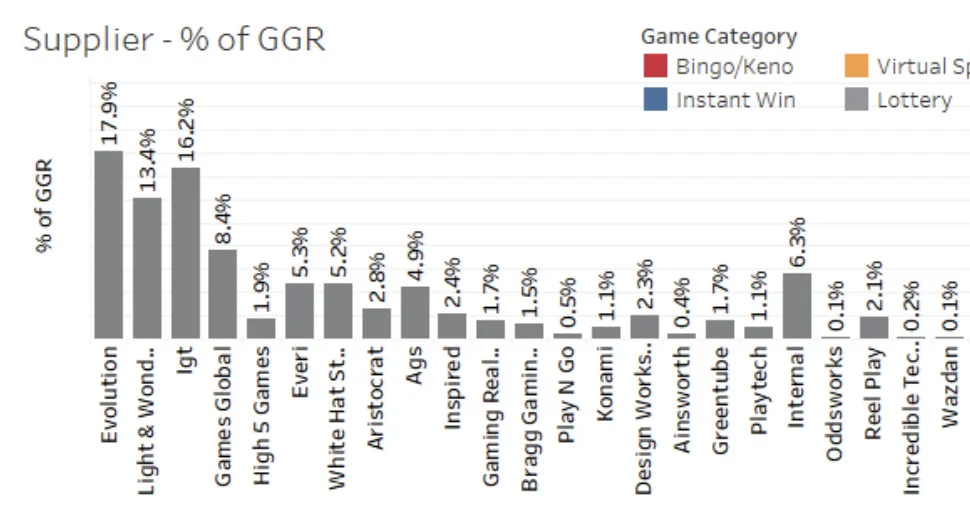

While Evolution and IGT kept their places as the top two brands in the supplier charts, each company saw their share of GGR drop for the second month in a row.

Evolution dropped from August’s 18.1% to 17.9%, while IGT fell for consecutive months from 17% to 16.2%.

Despite dropping in GGR share last month, Light & Wonder regained some of those losses as its percentage of GGR share rose to 13.4% from 13.3%.

Although smaller studios took home a higher GGR share last month as a result of the big three dropping points, Games Global fell to 8.4% from August’s 9.5% and Inspired dropped from 2.6% to 2.4%.

As per usual, slots remained the dominant segment for total games tracked, with a total of 91.5%, ahead of table games which stands at 3.4%.

Instant win was next with 2.1%, slightly ahead of live casino’s 1.4%, video poker’s 0.9 per cent, lottery’s 0.4% and bingo/keno’s 0.3%.

Mobile recorded the highest percentage of theoretical win generated per vertical with 72.1%, followed by desktop at 26.9% and tablet at 1%.

The latest US Eilers-Fantini report examined data from Michigan, West Virginia, Pennsylvania, New Jersey and Connecticut across 28 online casino sites, tracking 65,422 games to represent around 64% of the US market.

Canada stats

Eilers & Krejcik’s Canadian report continues to provide statistics on the nation’s online casino industry, covering nine online casino sites to track 10,686 games across five provinces.

Cash Eruption kept its position atop Canada’s top games by GGR chart for another month with 2.09% GGR share (August: 2.12%).

The slot gained a considerable portion of GGR share compared to the rest of the competition, more than doubling IGT’s Cleopatra slot which finished in second place with 1.02% (August: 1.03%).

After placing fifth in the August report, Everi’s Cash Machine title rose to third place with 0.9% (August: 0.79%), while Live Dealer Roulette fell from third to take fourth place with 0.83% GGR share (August: 1.34%).

Despite not securing a position in the top 10 games by GGR last month, IGT’s Big City 5s slot showed strong performance across September to round out the top five with 0.67% GGR share.

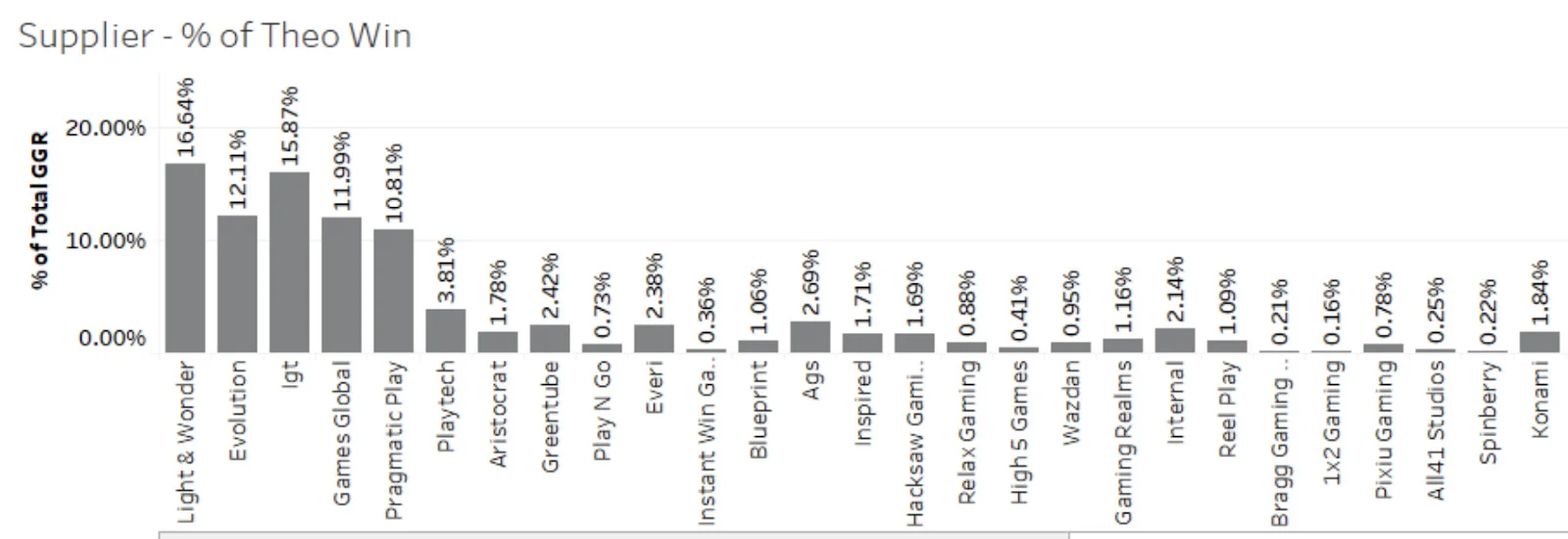

Similarly to the previous month, the top five suppliers by percentage of theoretical win were shaken up once again as Light & Wonder shot to the top of the rankings after finishing in fourth place in August.

The studio secured pole position with a 16.64% share of theoretical win, storming past IGT and Evolution which claimed 15.87% and 12.11%, respectively.

Games Global dropped into fourth as a result of Light & Wonder’s performance, claiming 11.99%, while Pragmatic Play took fifth place with 10.81%.

If interested in learning more, subscribing, or participating in the Eilers-Fantini Online Game Performance Database reach out to Rick Eckert at [email protected].